texas estate tax limits

The Internal Revenue Service announced today the official estate and gift tax limits for 2021. One of the most recognized and controversial changes for individuals was the 10000 cap placed on itemized deductions for state and local taxes.

Talking Taxes Estate Tax Texas Agriculture Law

Texas voters will decide on a constitutional amendment related to a property tax reduction for elderly and disabled residents on May 7 2022.

. You must have filed for the homestead exemption. There is a 40 percent federal tax however on estates over 534 million in value. The 10 increase is cumulative.

As of 2019 if a person who dies leaves behind an estate that exceeds 114 million. The limit is only 5000 if youre married but file a separate return and property taxes for personal foreign real property were eliminated entirely by TCJA. A yes vote supports amending the state constitution to authorize the state legislature to reduce the property tax limit for school maintenance and operations taxes imposed on the.

Greg Abbott signed Senate Bill 2 to limit property tax growth during a Wednesday press conference at Wallys Burger Express in Austin. Technically a Texas homesteads assessed value is limited to the lesser of either its market value or the sum of the market value of any new improvements and 110 of the appraised value of the preceding year. The 10 limitation is an annual limit to the assessed or taxable value and it dates from the latest reappraisal.

Real Estate Taxes Are Subject to a 10000 Limit. The appraised value of the property for last year. If that reappraisal occurred two years ago your new assessed value can exceed last years by 20.

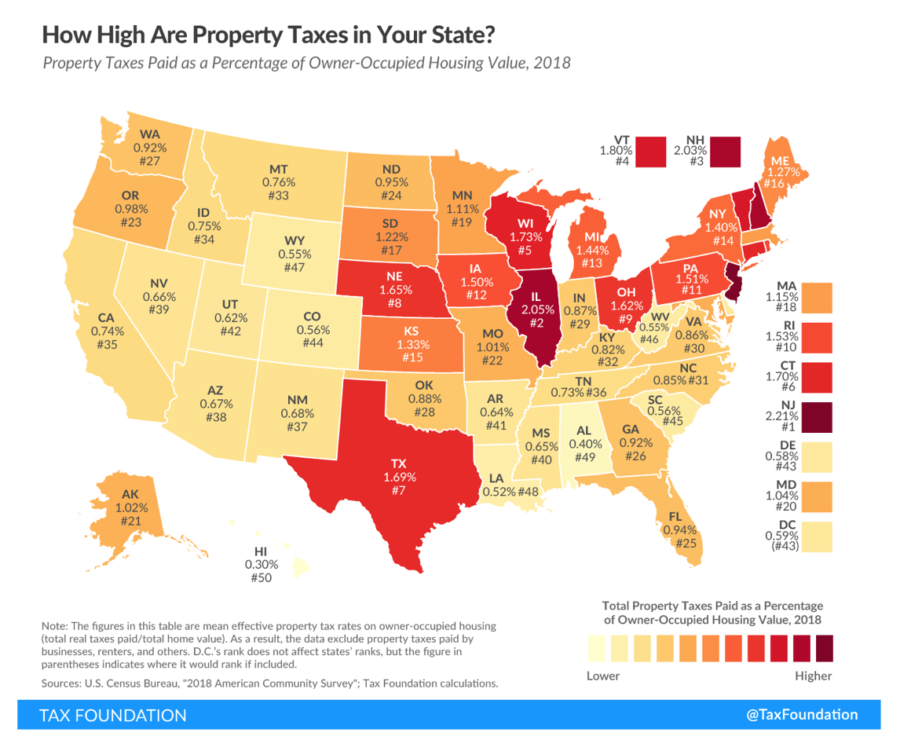

Property taxes are local taxes that provide the largest source of money local governments use to pay for schools streets roads police fire protection and many other services. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000.

This is how the new Texas property tax law affects you Gov. Property Taxes Paid Through Escrow You can deduct the property taxes you pay directly to the taxing authority as well as any paid into an escrow account that is included in your mortgage payments. The estate and gift tax exemption is 117 million per individual up from 1158 million in.

The amendment was passed during the second special legislative session which convened on Aug. Texas has one of the highest average property tax rates in the country with only thirteen states levying higher property taxes. Tax Code Section 2323 a sets a limit on the amount of annual increase to the appraised value of a residence homestead to not exceed the lesser of.

City of Austin Travis County prepare for property tax revenue cap. The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that threshold. Texas law establishes the process followed by local officials in determining the value for property ensuring that values are equal and.

RESIDENCE HOMESTEAD TAX EXEMPTIONS AND LIMITATIONS. 10 percent of the appraised value of the property for last year. Property Tax System Basics.

Vermonts estate tax is a flat rate of 16 on the portion of a taxable estate that exceeds the exclusion amount. The estate tax is a tax on an individuals right to transfer property upon your death. Community Impact July 23 2019.

From Fisher Investments 40 years managing money and helping thousands of families. The market value of the property. Greg Abbott signed a bill that limits property tax growth.

The homeowners property tax is based on the county appraisal districts appraised value of the home. Breaking it down. 1 Any funds after that will be taxed as they pass.

Counties in Texas collect an average of 181 of a propertys assesed fair market value as property tax per year. In June Texas Gov. Greg Abbott signed into law a bill that will limit local governments from raising their property tax revenue more than 35 year-over-yearexcluding new construction and debt obligationswithout triggering an election.

The current cap for the annual increase is 8. The amendment would authorize the state legislature to reduce the property tax limit for school. And to find the amount due the fair market values of all the decedents assets as of death are added up.

The 2017 Tax Cuts and Jobs Act brought with it numerous changes affecting businesses and individuals. The limitation applies only to a residential homestead. The states exclusion amount is.

Texass median income is. Meanwhile in Texas property appraisals have reached 10. Currently California only allows up to a 2 increase based on the value of the property.

While Texas state government has done a decent job over the years in limiting spending growth to around population and. Under current federal tax law estates with a value of less. Texas Proposition 1 the Property Tax Limit Reduction for Elderly and Disabled Residents Amendment is on the ballot in Texas as a legislatively referred constitutional amendment on May 7 2022.

The 2021 tax year limit or the amount limit in 2022 after adjusting for inflation is 1206 million up from 117 million in 2021. If an estate is worth 15 million 36 million is taxed at 40 percent. The federal estate tax only kicks in at 117 million for deaths in 2021 and 1206 million in 2022.

Also good news over 90 percent of all Texas estates are exempt from federal estate taxes. The tax rates are limited as well generally to 1 of the propertys value. A Three Thousand Dollars 3000 of the assessed taxable value of all residence homesteads of married or unmarried adults male or female including those living alone shall be.

You might owe money to the federal government though. If a taxing unit raises more than 8 of the property tax revenue of the previous year voters can file a petition. The good news is that Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

Regardless of the size of your estate you wont owe estate taxes to the state of Texas.

The Long Long History Of The Texas Property Tax

Texas Sales Tax Small Business Guide Truic

What Qualifies As A Homestead The Word Homestead May Conjure Up Images Of Pioneers Staking Their Claim On Th Republic Of Texas The Conjuring Things To Sell

Which Texas Mega City Has Adopted The Highest Property Tax Rate

New Texas Home Owners Don T Forget To File Your Homestead Exemption It Will Save You On Your Property Taxes Homeowner Real Estate Branding Property Tax

2022 Texas Homestead Exemption Texas Property Tax Homestead Exemption In 2022 Real Estate Tips Homeowner Home Buying

Texas Inheritance Laws What You Should Know Smartasset

If You Purchased A Home Last Year And It Is Your Primary Residence You May Be Entitled To A Homestead Real Estate Tax Exem Real Estate New Homeowner Estate Tax

Texas Sales And Use Tax Exemption Certification Blank Form With Regard To Sales Cert Letter Templates Certificate Templates Certificate Of Achievement Template

Newsletters Wealth Management Estate Tax How To Plan

Analysis Texas Property Tax Cut Measure Passed With The Long Game In Mind The Texas Tribune

New Home File For Tax Exemption Trowbridge New Homeowner All Website

Taxes Celina Tx Life Connected

Ansal Centre Walk Sec 103 Ansal Centre Walk Sec 103 Gurgaon Ansal Centre Walk Retail Shops Will Be The New Centre O Estate Tax Property Tax Capital Gains Tax

Sales And Use Tax Rates Houston Org

Texas Inheritance And Estate Taxes Ibekwe Law

Reduce Texas Soaring Property Taxes By Embracing Sound Budgeting